Sustainable Investing

Invest in a brighter future for yourself and the world, with our sustainable ISAs. When you invest your capital is at risk.

Total reviews

2784

Average rating

4.62

left to use your 2021/22 ISA allowance

Choose a more sustainable future for you and for our planet

If you want to make a positive difference, a sustainable investment plan could be the responsible investment you’re looking for.

This is also known as an ESG investment, which stands for environment, social and governance. You can read more about ESG investing below.

Saving into this fund, whether for yourself or your child, offers the opportunity to use your money for good while also aiming for a positive return on your investment.

- Your savings will be invested in companies tackling problems like climate change and economic and social injustice.

- These companies are carefully chosen for their potential for long-term growth

- You can relax knowing your savings won’t be used for non-sustainable or harmful activities.

It’s not just the products that we offer either, we are also committed to being a sustainable business.

What is an ESG fund?

ESG stands for environment, social and governance, so ESG funds invest in companies that tackle important challenges. Your savings could be working hard not just for you but also in helping make the world a better place.

Environmental

- Tackling climate change

- Reducing waste

- Improving energy efficiency

- Solving water scarcity

Social

- Campaigning for human rights

- Protecting consumer privacy

- Promoting gender equality

- Improving health & safety

Governance

- Making business more ethical

- Transparent financial reporting

- Greater accountability of boards

- Sustainability-linked executive pay

Invest sustainably with a Stocks and Shares ISA for yourself or your child

Thanks to our careful strategies, our members have enjoyed steady returns over the past 10 years. Open an ISA today or transfer funds from an ISA you already have.

Sustainable Stocks and Shares ISA

For any UK resident aged 18 and over.

- Make easy, flexible payments from £30 per month, or make single lump-sum payments online

- Invest up to your annual £20,000 ISA limit (which must include any other ISA you have, such as a Help to Buy, Lifetime or a cash ISA)

- Easy to set up and manage online

- You can pause, top up or change your payments at any time

- We aim for better returns than cash ISAs and savings accounts through annual bonuses.

When you invest your capital is at risk.

Sustainable Junior ISA

For parents or guardians to invest towards a lump sum for when your child turns 18.

- Save from £10 per month, or make a one-off payment of as little as £100

- Friends and family can contribute, too

- Our Sustainable Junior ISA is easy to set up and manage online

- You can pause, top up or change your payments at any time

- We aim for better returns than cash ISAs and savings accounts through annual bonuses

When you invest your capital is at risk.

The value of investments can fall, so you may get back less than you invest.

Because everyone can benefit

As a financial mutual built on fairness, our sustainable ISAs are part of our commitment to doing what’s right for our members and the planet. By investing in our sustainable ISAs, you’ll be making a positive impact too.

Working together

We’re a society that cares, always putting our members first. We thrive and succeed as a team, building trusting and rewarding relationships, inside and out.

Doing the right thing

We never compromise on our moral standards. We honour our commitments, always behave responsibly and act in

good faith.

Making a difference

We’re committed to providing the best possible products and services that help make a positive difference to the lives of our members.

How we manage your savings

Our stocks and shares ISA aims to deliver better returns than a cash ISA.

How we invest

Our Sustainable Stocks and Shares ISA and our Sustainable Junior ISA are with-profits investments, which aim to offer a smoother way to invest. They aim to deliver higher returns in the medium- to long-term compared with what you’d get from a bank or building society account.

We would prefer for you to receive smooth returns which are not overly affected by any sharp falls in the market. Therefore, the value of your investment with us will not change from day to day (unlike some stocks and shares ISAs which invest directly in shares or in a share-tracking index). In years when investments perform well, some of the profits are retained. This means that when market conditions aren’t as good, then we can still aim to pay an annual bonus.

However, in some circumstances, a market value reduction (MVR) could mean you get back less than you paid in, so the amount you receive can’t be guaranteed.

- Following periods of strong investment performance, you might get a final bonus

- Or, following periods of poor investment performance, you may get back less than the current value of your plan.

Where we invest

Our sustainable ISAs invest into the Sustainable Diversified Trust Fund (SDTF) which is actively managed by Royal London Asset Management (RLAM). You’ll be pleased to hear that this fund carries a 5/5 sustainability rating from Morningstar.

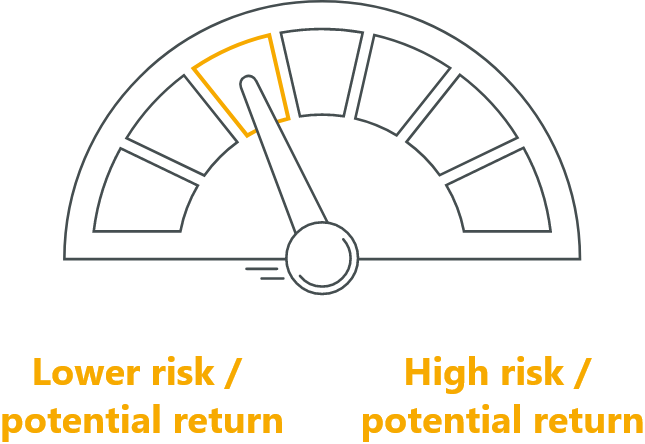

Your savings will be invested across stocks and shares, equities, bonds, and property. This spread means you’ll benefit from a medium- to low-risk investment strategy, where the goal is to achieve greater growth than you’d get from a cash savings account.

RLAM will only invest your savings in companies that make a positive contribution to the environment and society as a whole. Their simple belief is that managing investments in this way will benefit investors, companies, and the economy.

The annual management charge for this fund is 1.5%, deducted before your annual bonus is paid.

Of course, no investment is free from risk. The way these funds are managed means that your investment is at a medium to low level of risk. This may appeal to you if you prefer a smoother investment journey.

How we’re regulated

Shepherds Friendly is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. FS Registration Number 109997.

Why we’re trusted

We believe in keeping things simple, and putting our members first. That’s why we’re highly rated on independent review platforms, with over 2,750 reviews across REVIEWS.io and Trustpilot.

Please keep in mind that when you take out an investment product with us your capital is at risk and you may get back less than you have put in.

A free shopping voucher with every new plan

When you make your first payment into a Sustainable Stocks and Shares ISA or Sustainable Junior ISA, we’ll send you a Love2shop voucher code worth up to £50. Just our way of saying thanks for joining us.

Ready to start saving for your future?

Help to create a more sustainable future and start saving towards your own. Download the documents for all the key information about our sustainable ISAs. Remember that when you invest, your capital is at risk.

Frequently asked questions

-

What is sustainable investing?

Sustainable investing means investing in companies which are working to make a positive ESG difference (in other words, to the environment, society and governance). It aims to find the ideal balance between financial gains and delivering social good. Sustainability has become increasingly important in the investment world recently, with more and more people wanting to know what their money is being used for – and whether that’s aligned with their values.

-

Why is sustainable investing important?

More and more savers and investors now want to know where their money is going, what it’s being used for, and whether their investments are comfortably aligned with their values. So over the last decade, sustainability has become increasingly important in the investment world.

-

What is ESG?

ESG is a recognised way of measuring sustainability according to environmental, social and governance impact.

-

What is the ISA allowance or limit?

This is the maximum amount you can pay into an ISA within each tax year. Set by the government, it usually rises in line with the Consumer Prices Index. Please note that these limits apply to the total held across all of your personal ISAs, and that tax rules are always subject to change. In the current tax year, the allowances are:

- For adult ISAs: £20,000

- For Under 18s: £9,000

-

Can I withdraw from my Sustainable Stocks and Shares ISA?

If you’re an adult holding our Sustainable Stocks & Shares ISA, you can withdraw money whenever you like. However, do bear in mind that that our ISA is designed for medium- to long-term investment, and making regular withdrawals could reduce its value. Any money withdrawn will also reduce your ISA allowance for that tax year, and it can’t be repaid into an ISA until the following tax year. Please note that money cannot be withdrawn from our Sustainable Junior ISA until the child reaches the age of 18.

-

Who can open a Sustainable Junior ISA?

A Junior ISA can only be opened by a parent or guardian of the child. However, friends and family can pay into it as part of the maximum annual allowance of £9,000.

Our Member Services Team are always happy to help.

You can call them on 0800 526 249.

Important things to consider

- Past performance cannot be taken as a guarantee of future returns.

- Bonus rates vary from year to year depending on the performance of our investments and in some years we may not pay out any at all.

- HM Revenue and Customs may change the tax status of an ISA or Junior ISA in the future.

- Inflation may affect the purchasing value of the investment in the future.

- Money invested into a Junior ISA cannot be withdrawn early; it can only be withdrawn by the child when they reach the age of 18 years old.

- If you have been invested through periods of poor investment performance, and you leave the fund, you may get back less than the current value of your plan. This is known as a Market Value Reduction (MVR).

When you take out an investment product with us your capital is at risk and you may get back less than you have put in. All references to taxation are to UK taxation and are based on Shepherds Friendly Society’s understanding of current legislation and H M Revenue and Customs practice which may change in the future. Investment growth is by means of bonuses, the amount of which cannot be guaranteed throughout the term of the contract. Please ensure that you read the full terms and conditions of this plan which are available from your financial adviser or by contacting us directly.

Please note: No advice has been given by Shepherds Friendly, and if you are in any doubt as to whether a savings plan is suited to your needs, then you should contact a financial adviser. There may be a charge for financial advice, and the cost should be confirmed to you before any advice is given.